Partners Program

Objective: Enhance and foster partnerships with CPS CPS Partner program offers a unique avenue for continuous relations building, recognized support of the CPS Mission, opportunities for visibility to our members, and more. All activities with our Partners will follow the CPS Policy on Corporate Relationships and External Support.* Learn more below. *This policy will be reviewed on an annual basis. Become a CPS PartnerMeet Our Partners!Learn more about our partners by clicking on their logos below. Sustaining Partners:

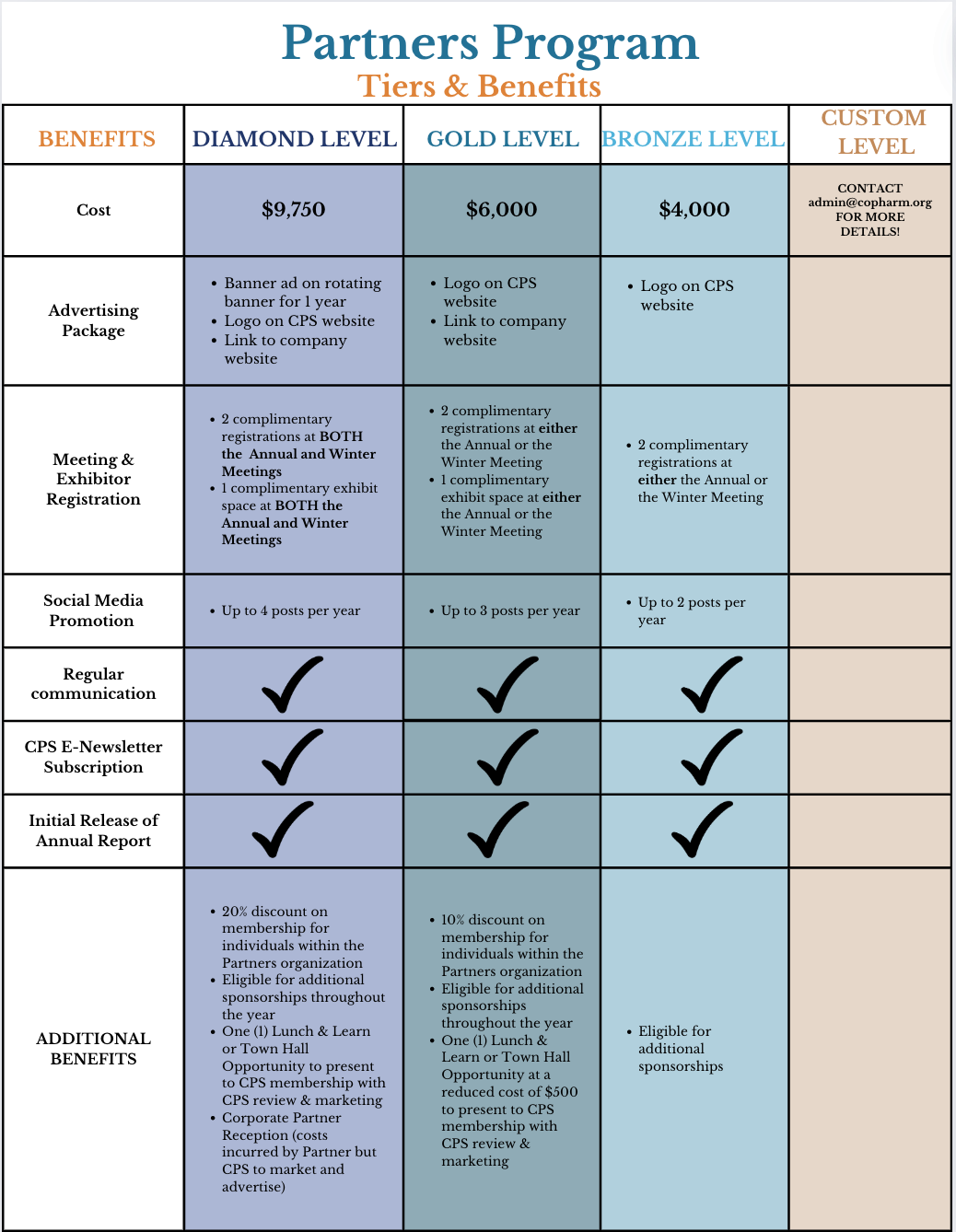

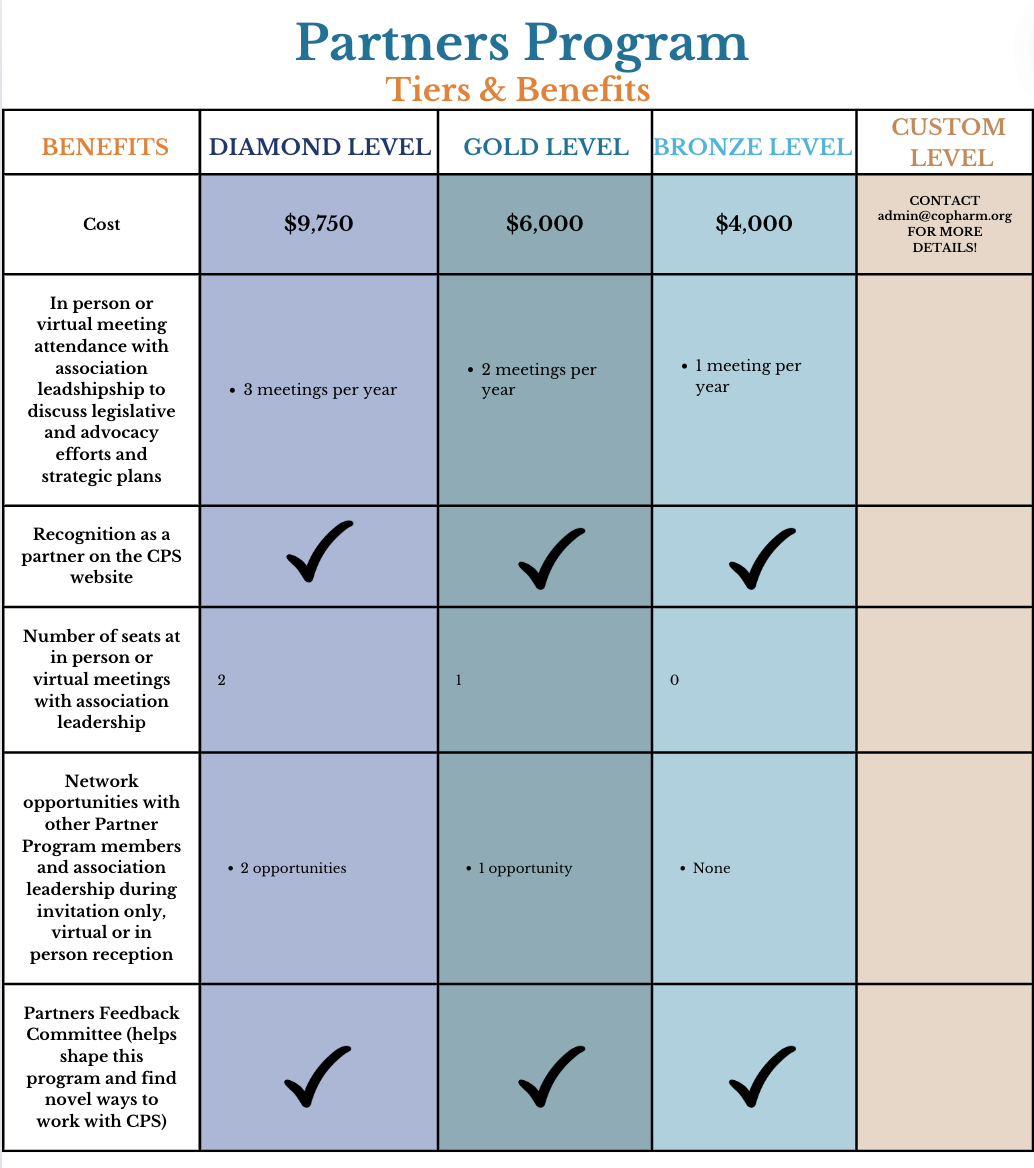

Diamond Level Partner:

Gold Level Partner:

Custom Level Partners:

Become a CPS Partner

Become a CPS PartnerContribution or gifts to the Colorado Pharmacists Society are not deductible as charitable contributions for federal income tax purposes. However, such payments may be deductible as business expenses or other provisions of the Internal Revenue Code. The Internal Revenue Service requires notification of the allocation of lobbying expense included in total membership dues which is not deductible. This amount is 30% of dues. Please consult with your accountant or tax attorney on these matters.

|